Tuesday, April 23, 2013

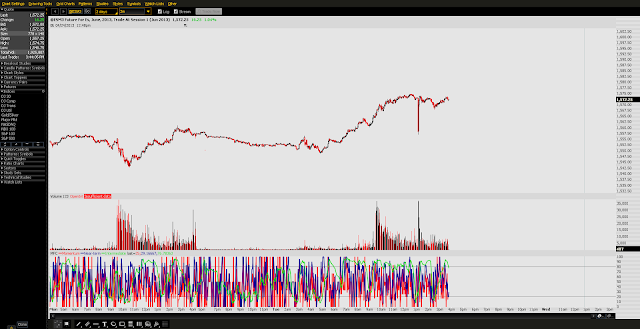

Futures 2 Minute Flash Similar to Gold Crash

The volume spike was enormous as is evident from this view. This is the same type of reaction we saw in the Gold markets earlier, where the volume on the sell side totally overwhelmed the system. The Gold Futures contract is 100 oz. When 100 metric tonnes goes out in one sell order, the type of reaction we had ensues. The system gradually unwinds and equilibrium is ultimately found. This type of volatility comes with the territory, but this is unexplored territory for all traders in this time. There has never before been an environment with such expansive algorithms at work: unbeknownst to day traders, swing traders, and investors alike, who is executing the trades-- be it human beings, or artificial intelligence.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment