To Apply to ThinkorSwim by TDAmeritrade

Choose 'New' in the Edit Studies Dialog Box

Name the Study Appropriately

Paste Code

Apply, Ok

Done!

Each day input the VAL, VAL, POC, and Pivot from ShadowTrader either from the Tools, MyTrade subtab in the ThinkorSwim platform, or directly from their site at ShadowTrader.net

*Hint: Set the opening time to '1' instead of '9:30' to have the study plot after hours...

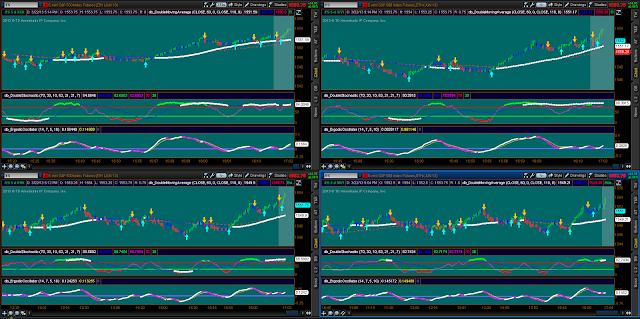

dWbValueArea

#Inputs

input Pivot = 0.00;#Hint Pivot: Must be manually entered

daily, tinyurl.com/3lbmu4o

input VAH =

0.00;#Hint VAH: Must be manually entered daily, tinyurl.com/3lbmu4o

input POC =

0.00;#Hint POC: Must be manually entered daily, tinyurl.com/3lbmu4o

input VAL =

0.00;#Hint VAL: Must be manually entered daily, tinyurl.com/3lbmu4o

input Automate = yes;#Hint Automate: This will calc &

dispaly pivot values automatically with “Pivot” input. Value Area will always

display.

input ProximityPlot = no;#Hint ProximityPlot: Only plots

pivots when applicable. If “Automate” is “no”, this option doesnt matter. Value

Area will always display.

input PivotBubbles = yes;#Hint PivotBubbles: Shows bubbles

on pivot plot lines. If ProximityPlot= yes, bubbles are always off.

input Labels = { default “Proximity”, “Off”, “All”};#Hint

Labels: Labels at top of chart. Proximity=labels will display only when

applicable.

input ShowPivot = no;#Hint ShowPivot: Some people do not use

the pivot point and do not want it displayed.

input ShowLevel4 = no;#Hint ShowLevel4: Will display S4 and

R4 for volatile days.

input CloudStartTime = 0530;#Hint CloudStartTime: Move to an

earlier time to shift bubbles to the left if bubbles are interfering with chart

view.

input ShowCloud = yes;#Hint ShowCloud: Shows the value area

as a cloud.

input LabelEsChartOnly = yes;#Hint LabelEsChartOnly: Removes

Value Labels(“Above Value”etc.) from chart when another symbol is entered(ex.

GOOG).

#Value Area Functions

def VArea = if close >= VAL and close <= VAH then 1

else 0;

def VAreaabove = if close > VAH then 1 else 0;

def VAreabelow = if close < VAL then 1 else 0;

def EStest = if close > close (“/es”) – 15 and close <

close (“/es”) + 15 then 1 else 0;

def ESchartonly = if LabelEsChartOnly then EStest else 1;

def NotZero = if VAH > 0 and VAL > 0 then 1 else 0;

def PNotZero = if Pivot > 0 then 1 else 0;

#Previous Day Functions

def Day =

GetDayOfWeek(GetYYYYMMDD() );

def RegHrs = SecondsTillTime(1545) >= 0 and

SecondsFromTime(0930) >= 0;

rec PLow = CompoundValue(1, if Day == Day[1] and RegHrs

and low < PLow[1] then low else if SecondsFromTime(0930) <= 0 and RegHrs

then low else PLow[1], low);

rec PHigh = CompoundValue(1, if Day == Day[1] and RegHrs and

high > PHigh[1] then high else if SecondsFromTime(0930) <= 0 and RegHrs

then high else PHigh[1], high);

rec PrevLow = if Day

!= Day[1] then PLow[1] else PrevLow[1];

rec PrevHigh = if Day != Day[1] then PHigh[1] else

PrevHigh[1];

#Time Functions

def AfterHours = no;

def MarketCloseTime =

1615;

def secondsFromOpen =

SecondsFromTime(CloudStartTime);

def secondsTillClose = SecondsTillTime(MarketCloseTime);

def OpenTest = if secondsFromOpen >= 0 and

secondsTillClose > 0 then yes else no;

def MarketOpen = if AfterHours or OpenTest then 1 else 0;

def closeByPeriod = close(period = “DAY”)[-1];

def newDay = if !IsNaN(closeByPeriod) then 0 else 1;

def today = if

GetDay() == GetLastDay() and SecondsFromTime(CloudStartTime) >= 0 then 1

else 0;

#Pivot Functions

def RI = (2 * Pivot)

– PrevLow;

def SI = (2 * Pivot)

– PrevHigh;

def RII = Pivot + (RI

– SI);

def SII = Pivot – (RI

– SI);

def RIII = PrevHigh + 2 * (Pivot – PrevLow);

def SIII = PrevLow – 2 * (PrevHigh – Pivot);

def RIV = PrevHigh +

3 * (Pivot – PrevLow);

def SIV = PrevLow – 3

* (PrevHigh – Pivot);

#Plots

plot VH;

plot PC;

plot VL;

plot R1;

plot S1;

plot R2;

plot S2;

plot R3;

plot S3;

plot R4;

plot S4;

plot PP;

plot R_1;

plot S_1;

plot R_2;

plot S_2;

plot R_3;

plot S_3;

plot R_4;

plot S_4;

plot P_P;

if !IsNaN(close(period = “DAY”)[-1])

then {

VH = Double.NaN;

PC = Double.NaN;

VL = Double.NaN;

R4 = Double.NaN;

R3 = Double.NaN;

R2 = Double.NaN;

R1 = Double.NaN;

PP = Double.NaN;

S1 = Double.NaN;

S2 = Double.NaN;

S3 = Double.NaN;

S4 = Double.NaN;

R_4 = Double.NaN;

R_3 = Double.NaN;

R_2 = Double.NaN;

R_1 = Double.NaN;

P_P = Double.NaN;

S_1 = Double.NaN;

S_2 = Double.NaN;

S_3 = Double.NaN;

S_4 = Double.NaN;

} else {

VH = if MarketOpen and newDay and today and VAH

> 0 then VAH else Double.NaN;

PC =

if MarketOpen and newDay and today and POC > 0 then POC else Double.NaN;

VL = if MarketOpen and newDay and today and VAL

> 0 then VAL else Double.NaN;

R4 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and

ShowLevel4 and RIV > 0 then RIV else Double.NaN;

R3 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and RIII

> 0 then RIII else Double.NaN;

R2 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and RII >

0 then RII else Double.NaN;

R1 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and RI >

0 then RI else Double.NaN;

PP = if MarketOpen and newDay and today and

ShowPivot and !ProximityPlot and Pivot > 0 then Pivot else Double.NaN;

S1 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and SI >

0 then SI else Double.NaN;

S2 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and SII >

0 then SII else Double.NaN;

S3 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and SIII

> 0 then SIII else Double.NaN;

S4 = if MarketOpen and newDay and today and

Automate and !ProximityPlot and

ShowLevel4 and SIV > 0 then SIV else Double.NaN;

R_4 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close >

(RII + ((RIII - RII) / 2)) then RIV else Double.NaN;

R_3 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close >

(RI + ((RII - RI) / 2)) then RIII else Double.NaN;

R_2 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close >

VH then RII else Double.NaN;

R_1 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close >

VL then RI else Double.NaN;

P_P = if

MarketOpen and newDay and today and Automate

and ShowPivot and ProximityPlot and close > SI and close < RI then

Pivot else Double.NaN;

S_1 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close <

VH then SI else Double.NaN;

S_2 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close <

VL then SII else Double.NaN;

S_3 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close <

(SI - ((SI - SII) / 2)) then SIII else Double.NaN;

S_4 = if

MarketOpen and newDay and today and Automate

and ProximityPlot and close <

(SII - ((SII - SIII) / 2)) then SIV else Double.NaN;

}

VH.SetPaintingStrategy(PaintingStrategy.LINE);

VH.SetDefaultColor(Color.RED);

VH.SetLineWeight(1);

PC.SetPaintingStrategy(PaintingStrategy.LINE);

PC.SetDefaultColor(Color.YELLOW);

PC.SetLineWeight(1);

PC.SetStyle(Curve.LONG_DASH);

VL.SetPaintingStrategy(PaintingStrategy.LINE);

VL.SetDefaultColor(Color.GREEN);

VL.SetLineWeight(1);

R4.SetPaintingStrategy(PaintingStrategy.LINE);

R4.SetDefaultColor(Color.WHITE);

R4.SetLineWeight(1);

R3.SetPaintingStrategy(PaintingStrategy.LINE);

R3.SetDefaultColor(Color.WHITE);

R3.SetLineWeight(1);

R2.SetPaintingStrategy(PaintingStrategy.LINE);

R2.SetDefaultColor(Color.WHITE);

R2.SetLineWeight(1);

R1.SetPaintingStrategy(PaintingStrategy.LINE);

R1.SetDefaultColor(Color.WHITE);

R1.SetLineWeight(1);

PP.SetPaintingStrategy(PaintingStrategy.LINE);

PP.SetDefaultColor(Color.WHITE);

PP.SetLineWeight(1);

S4.SetPaintingStrategy(PaintingStrategy.LINE);

S4.SetDefaultColor(Color.WHITE);

S4.SetLineWeight(1);

S3.SetPaintingStrategy(PaintingStrategy.LINE);

S3.SetDefaultColor(Color.WHITE);

S3.SetLineWeight(1);

S2.SetPaintingStrategy(PaintingStrategy.LINE);

S2.SetDefaultColor(Color.WHITE);

S2.SetLineWeight(1);

S1.SetPaintingStrategy(PaintingStrategy.LINE);

S1.SetDefaultColor(Color.WHITE);

S1.SetLineWeight(1);

R_4.SetPaintingStrategy(PaintingStrategy.LINE);

R_4.SetDefaultColor(Color.WHITE);

R_4.SetLineWeight(1);

R_4.HideBubble();

R_3.SetPaintingStrategy(PaintingStrategy.LINE);

R_3.SetDefaultColor(Color.WHITE);

R_3.SetLineWeight(1);

R_3.HideBubble();

R_2.SetPaintingStrategy(PaintingStrategy.LINE);

R_2.SetDefaultColor(Color.WHITE);

R_2.SetLineWeight(1);

R_2.HideBubble();

R_1.SetPaintingStrategy(PaintingStrategy.LINE);

R_1.SetDefaultColor(Color.WHITE);

R_1.SetLineWeight(1);

R_1.HideBubble();

P_P.SetPaintingStrategy(PaintingStrategy.LINE);

P_P.SetDefaultColor(Color.WHITE);

P_P.SetLineWeight(1);

P_P.HideBubble();

S_4.SetPaintingStrategy(PaintingStrategy.LINE);

S_4.SetDefaultColor(Color.WHITE);

S_4.SetLineWeight(1);

S_4.HideBubble();

S_3.SetPaintingStrategy(PaintingStrategy.LINE);

S_3.SetDefaultColor(Color.WHITE);

S_3.SetLineWeight(1);

S_3.HideBubble();

S_2.SetPaintingStrategy(PaintingStrategy.LINE);

S_2.SetDefaultColor(Color.WHITE);

S_2.SetLineWeight(1);

S_2.HideBubble();

S_1.SetPaintingStrategy(PaintingStrategy.LINE);

S_1.SetDefaultColor(Color.WHITE);

S_1.SetLineWeight(1);

S_1.HideBubble();

#Value Area Cloud

plot cloudhigh = if MarketOpen and newDay and today and

ShowCloud then VAH else Double.NaN;

plot cloudlow = if

MarketOpen and newDay and today and ShowCloud then VAL else Double.NaN;

AddCloud (cloudhigh, cloudlow, Color.GRAY, Color.GRAY);

#Labels

AddLabel(MarketOpen and newDay and today and ESchartonly and

VArea and NotZero, “Inside Value Area”, Color.WHITE);

AddLabel(MarketOpen and newDay and today and ESchartonly and

VAreaabove and NotZero, “Above Value Area”, Color.GREEN);

AddLabel(MarketOpen and newDay and today and ESchartonly and

VAreabelow and NotZero, “Below Value Area”, Color.RED);

def ChartLabels;

switch (Labels) {

case “Proximity”:

ChartLabels = 1;

case “Off”:

ChartLabels = 0;

case “All”:

ChartLabels = 2;

}

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close > VL and close < RII, Concat(“VH=”, VH),

Color.RED);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close > SI and close < RI, Concat(“POC=”, PC),

Color.YELLOW);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close < VH and close > SII, Concat(“VL=”, VL),

Color.GREEN);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close > VL, Concat(“R1=”, RI), Color.RED);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close > VH, Concat(“R2=”, RII), Color.RED);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close > (RI + ((RII - RI) / 2)), Concat(“R3=”,

RIII), Color.RED);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close > (RII + ((RIII - RII) / 2)), Concat(“R4=”,

RIV), Color.RED);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close > SI and close < RI and ShowPivot,

Concat(“PP=”, PP), Color.WHITE);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close < VH, Concat(“S1=”, SI), Color.GREEN);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close < VL, Concat(“S2=”, SII), Color.GREEN);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close < (SI - ((SI - SII) / 2)), Concat(“S3=”,

SIII), Color.GREEN);

AddLabel(ChartLabels == 1 and MarketOpen and newDay and

today and ESchartonly and close < (SII - ((SII - SIII) / 2)), Concat(“S4=”,

SIV), Color.GREEN);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and NotZero, Concat(“VH=”, VH), Color.RED);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and NotZero, Concat(“POC=”, PC), Color.YELLOW);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and NotZero, Concat(“VL=”, VL), Color.GREEN);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero, Concat(“R1=”, RI), Color.RED);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero, Concat(“R2=”, RII), Color.RED);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero, Concat(“R3=”, RIII), Color.RED);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero and ShowLevel4, Concat(“R4=”, RIV), Color.RED);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero and ShowPivot, Concat(“PP=”, PP),

Color.WHITE);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero, Concat(“S1=”, SI), Color.GREEN);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero, Concat(“S2=”, SII), Color.GREEN);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero, Concat(“S3=”, SIII), Color.GREEN);

AddLabel(ChartLabels == 2 and MarketOpen and newDay and

today and ESchartonly and PNotZero and ShowLevel4, Concat(“S4=”, SIV),

Color.GREEN);

AddLabel(!MarketOpen, ”NoPlotAfterHours”, Color.WHITE);

#Bubbles

AddChartBubble (!IsNaN(S1) and IsNaN(S1[1]) and

PivotBubbles, S1, “S1”, Color.WHITE, no);

AddChartBubble (!IsNaN(S2) and IsNaN(S2[1]) and

PivotBubbles, S2, “S2”, Color.WHITE, no);

AddChartBubble (!IsNaN(S3) and IsNaN(S3[1]) and

PivotBubbles, S3, “S3”, Color.WHITE, no);

AddChartBubble (!IsNaN(S4) and IsNaN(S4[1]) and PivotBubbles

and ShowLevel4, S4, “S4”, Color.WHITE, no);

AddChartBubble (!IsNaN(PP) and IsNaN(PP[1]) and ShowPivot

and PivotBubbles, PP, “PP”, Color.WHITE, no);

AddChartBubble (!IsNaN(R1) and IsNaN(R2[1]) and

PivotBubbles, R1, “R1”, Color.WHITE, no);

AddChartBubble (!IsNaN(R2) and IsNaN(R2[1]) and

PivotBubbles, R2, “R2”, Color.WHITE, no);

AddChartBubble (!IsNaN(R3) and IsNaN(R3[1]) and

PivotBubbles, R3, “R3”, Color.WHITE, no);

AddChartBubble (!IsNaN(R4) and IsNaN(R4[1]) and PivotBubbles

and ShowLevel4, R4, “R4”, Color.WHITE, no);

#Opening Range Breakout Functions

input ShowORB = No;#Hint ShowORB: Displays 2 small, dashed

lines at the top/bottom of the opening range.

input OrbTime = 30;#Hint OrbTime: Defines the time range for

the ORB.

def Market_Open_Time

= 945;

def Market_Close_Time = 1600;

def Day1 = GetDay();

def pastOpen =

If((SecondsTillTime(Market_Open_Time) > 0), 0, 1);

def pastClose = If((SecondsTillTime(Market_Close_Time) >

0), 0, 1);

def IsMarketOpen = If(pastOpen and !pastClose, 1, 0);

def firstBar = If (Day1[1] != Day1, Day1 – 1, 0);

def secondsUntilOpen = SecondsTillTime(Market_Open_Time);

def regularHours = SecondsTillTime(Market_Close_Time);

def secondsFromOpen1 = SecondsFromTime(Market_Open_Time);

def pastOpeningRange = If(secondsFromOpen1 >= ((OrbTime -

15) * 60), 1, 0);

rec displayedHigh = If(high > displayedHigh[1] and

IsMarketOpen and ShowORB, high, If(IsMarketOpen and !firstBar,

displayedHigh[1], high));

rec displayedLow =

If(low < displayedLow[1] and IsMarketOpen and ShowORB, low, If(IsMarketOpen

and !firstBar, displayedLow[1], low));

rec ORHigh = If(pastOpeningRange, ORHigh[1], displayedHigh);

rec ORLow =

If(pastOpeningRange, ORLow[1], displayedLow);

plot ORBHigh = If(MarketOpen and newDay and today and

pastOpeningRange and IsMarketOpen and ShowORB, ORHigh, Double.NaN);

plot ORBLow =

If(MarketOpen and newDay and today and pastOpeningRange and IsMarketOpen and

ShowORB, ORLow , Double.NaN);

ORBHigh.SetDefaultColor(Color.GRAY);

ORBHigh.SetLineWeight(1);

ORBHigh.SetStyle(Curve.SHORT_DASH);

ORBHigh.HideBubble();

ORBLow.SetDefaultColor(Color.GRAY);

ORBLow.SetLineWeight(1);

ORBLow.SetStyle(Curve.SHORT_DASH);

ORBLow.HideBubble();