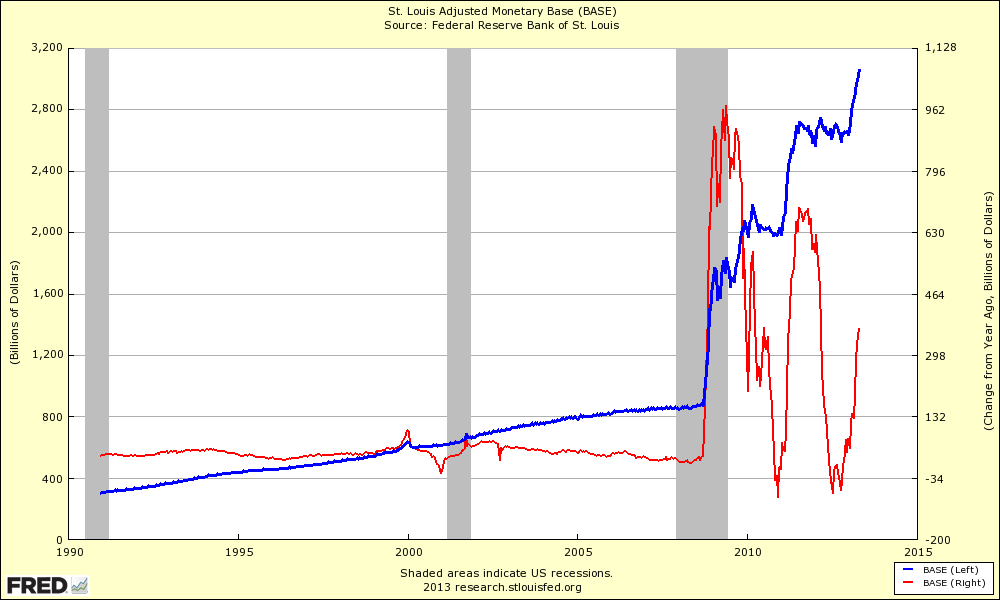

Another concern is the impact that the growing Federal Reserve balance sheet has had on stocks and given that techs responded first to trillions in stimulus, they are likely to be the most vulnerable to any attempts to shrink the balance sheet, which is why I am keeping a close watch on the rate of change data from by the St. Louis Federal Reserve (see Figure 3).

Figure 3 – Data from the St Louis Federal Reserve comparing the Adjusted Monetary Base or AMB (blue, left-hand scale) with the rate of change in billions$ from the year prior (red, right hand scale). Note how quickly the AMB is expanding at a rate of more than $300 billion per year as of the latest data on April 17. |

| Graphic provided by: St. Louis Federal Reserve. |

| So why has the Fed revved the printing presses lately? Clearly the Fed is very concerned about weakness in stocks ahead. Surely they can't still believe it will help the economy given all the data that has been published to the contrary? From a stock perspective, the explosion in AMB has to be the biggest stock price impetus and may explain the strength in GOOG, AAPL, and FB lately. But these stocks are equally vulnerable to a sell off should the AMB begin to reverse or some other event scares investors. |

No comments:

Post a Comment